The 3 Golden Rules for Selecting the Right Option to Sell

Deciding to commit capital to an option-selling portfolio can lead to a multitude of considerations. One of the first—and perhaps most critical—questions for those new to option selling is, “How do I identify the right options to sell?”

Even if you’re working with a managed account, where professionals handle the selection process, understanding the criteria for option selection can deepen your perspective. This month’s column offers the three foundational principles, built on decades of industry experience, for identifying options that align with long-term goals while attempting to manage risk effectively.

The Reality of Choosing the “Right” Option

There’s a misconception in the world of options that with the right formula or software, you can discover the “perfect” option to sell. However, real-world experience tells us otherwise: there’s no perfect option, only the right approach. Option selling isn’t about finding the “best” choice. It’s about making effective choices that avoid substantial risks while capitalizing on time decay. Every option either passes or fails based on whether it expires within your risk parameters.

The value of selling options is that you don’t need perfection; you only need precision. You’re aiming to create a resilient strategy that performs consistently over time, regardless of minor market fluctuations. Below are what we believe are three principles for selecting options that increase your odds of favorable outcomes.

Futures and options involve the risk of loss which should be thoroughly understood before trading. Short options entail the risk of margin calls or forced liquidation in the event of an adverse price movement, with uncovered short options carrying virtually unlimited risk. Alternative Options offers a fully covered trading program in order to address some of those issues.

Defining Your Objective

Your goal is straightforward: find options that not only expire worthless but also decay steadily. Adverse market movements can increase the premium on your short position, creating volatility and stress. The optimal approach focuses on minimizing such fluctuations, selecting options that “quietly” decay. Here are three “Golden Rules” developed over years of experience to help you achieve just that.

The Three Golden Rules

1. Understand the Fundamentals

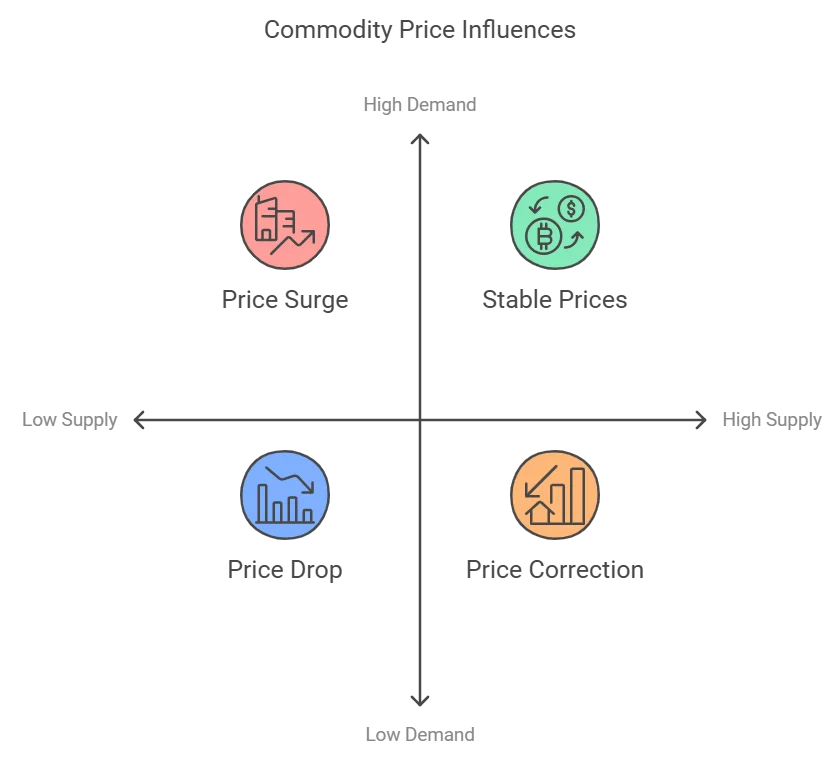

In commodities, prices are heavily influenced by the basic principles of supply and demand. Unlike equities, where market sentiment often sways prices, commodities respond to the physical realities of production, demand, and inventory levels. This is where seasoned commercial traders excel, they have a profound understanding of these fundamentals, and so should you.

A firm grasp of fundamentals gives you an edge. While technical analysis can be helpful, integrating fundamental insights into your strategy may enhance your position. Consider reputable sources like the USDA, EIA, or specialized subscription services for reliable data. Staying informed on the forces that influence commodity prices allows you to make more informed choices.

2. Prioritize Deep Out-of-the-Money Options

Focus on markets where premium is available deep out of the money. Options that are 30%, 40%, or even up to 100% out of the money present a more favorable risk profile. In commodities, such levels are often accessible, allowing you to select strikes far enough from the underlying price to lower the likelihood of ending up in the money.

Selling options far out of the money places distance between your position and any potential price movement. It enables you to manage risk based primarily on the option’s value, instead of relying solely on underlying price changes.

3. Trade Time for Distance

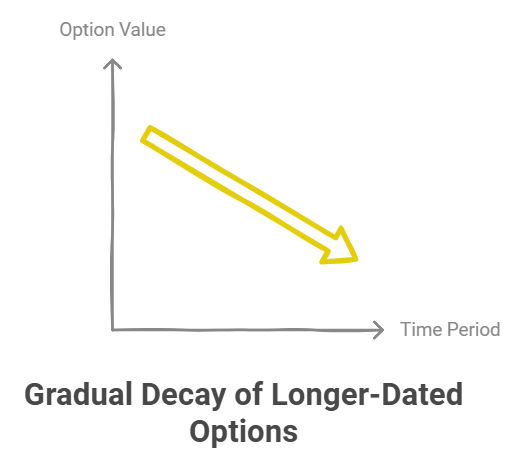

This principle is core to the long-term strategy we advocate for high-net-worth clients. Many resources advise selling options with around 30 days to expiration, as this maximizes time decay. While this can be effective with stock options, we find it less suitable for commodities. Selling options with minimal time to expiration often requires you to sell closer to the money, which exposes you to greater volatility and risk of being in the money.

Instead, consider selling options with a longer time horizon—3, 6, or even 9 months. This enables you to select strikes well out of the money, which may help to shield your position from short-term market fluctuations. This approach offers a balanced strategy that capitalizes on time decay while keeping your strikes at a comfortable distance from the market price.

A Strategic Foundation for Option Selection

Selecting the right options to sell is only the beginning. Proper strategy, diligent risk management, and thoughtful portfolio construction are essential to a successful options portfolio. Whether you choose to manage your options or entrust them to a professional, understanding these principles allows you to make more informed, strategic choices.

Futures and options involve the risk of loss which should be thoroughly understood before trading. Short options entail the risk of margin calls or forced liquidation in the event of an adverse price movement, with uncovered short options carrying virtually unlimited risk. Alternative Options offers a fully covered trading program in order to address some of those issues.

Is Managed Option Selling For You?

Learn How to put the Pros to work on Your behalf. Are you a high net worth investor seeking the potentially high yields and diversification that only selling can offer? A managed portfolio can give you access to these benefits without the time commitment or experience necessary to excel in writing options. Learn all the details inside our Free Investor Discovery Kit. Get yours today!

Option selling involves the risk of loss